Fintech Startups Market Insights To Prepare You For 2022 And Beyond

In this blog post we would like to cover trends for 2022 in the FinTech startup arena. As we approach what Mr. Klaus Schwab of the WEF tails the “Fourth Industrial Revolution”, disruption and innovation is the name of what we will be seeing this decade.

The pandemic has forced many businesses to upgrade their technology and capabilities to operate their companies from home in addition to new technologies that are being introduced daily to meet the needs of banking and the transference of wealth.

The financial tech space is sure to bring many disruptions to all industries as it involves the one thing that every single person needs and utilizes: money.

FINTECH STARTUPS: An Alternative To Banking

What does fintech mean? It originates from the word, finance and technology. Using technology to conduct finance.

As e-commerce takes a foothold in the global marketplace, there has been massive disruptions to how commerce is conducted. Recently many brick and mortar businesses are moving online. I would like to share something actually which is that even that of my parent’s companies has recently launched their first e-commerce store for B2B in the flexible packaging manufacturing field and they some of the most conservative people I know. This goes to show the amount of disruption and hence innovation the past 2 years has caused.

Payment Gateways

Payment gateways are used as an alternative to bank’s merchant accounts to the payments industry. When you think of payment gateways, companies such as PayPal or Stripe come to mind. It’s simply a way to accept payment transactions online without the use of a merchant account from bank. The reach from payment gateways are enormous because the potentiality of it is near infinite. This is due to the fact that payment gateways do not have abide to stricter bank regulations, although they do have to abide by PCI compliance as they work have to work directly with banks to approve payments.

To explain it simply, a payment gateway acts an intermediary between a merchant (someone that is selling a product online) and the bank account. Where-for, a transaction directly into the bank would not be good in the case of refunds, disputes and incorrect statements. Therefor funds need to be held in an intermediary first which is the payment gateway.

In the past, this process would have to be authorized by your local bank, which is an extremely tedious and inefficient process, especially when conducting business in multiple countries. Whereas payment gateways gives you freedom and and also control to businesses operating online.

One company, Omise, which is a leading payment gateway based in Southeast Asia & Japan is set to transform the local landscape through their broad array of services which include payments, mobile based QR payments, convenience store payments and more. The philosophy behind this company is to give everybody access to online payments.

Especially in developing countries in Southeast Asia, the standard of living is still not very high compared to the West. There are many individuals that do not have access to a bank account. Online payments offer a solution to this as anyone that has access to an internet connection can access payments or start their own business. Education will also play a role into transforming the landscape of developing nations, which I foresee will be near developed by 2030.

As many new blood entrepreneurs are taking themselves to the spotlight, expect to see a lot of payment gateways acting as the bridge between the consumer and the business for global transactions.

The reason why the payment industries is so disruptive is because of how it gives easy access for new entrepreneurs to enter the scene. In the past, entrepreneurs will need to invest a lot of capital to start their business up which involves high risk. Nowadays, entrepreneurs can set up their online store in less than a week which integrates with a payment processor. This is what I believe will create wealth for the world, because of automation through technology, education and mentors in the field. The internet, which acts as a bedrock is what allows for the redistribution of wealth for us to truly become a global society.

Cryptocurrencies

With the recent hype of Bitcoin, Ethereum and other cryptocurrencies, investments in this field has reached an all time high of nearly $2.21 trillion.

Cryptocurrencies are a sign away from the money system where fraud and inflation can be caused by a single bank. Banks holds enormous power over the world, and if you study history – the international bankers practically own the world’s money supply. These families include the Rothschilds and the Rockefellers. A bank can simply one day choose to print hundreds of thousands of dollars, backed by basically nothing which causes inflation and all sorts of nasty economic recessions.

Cryptocurrency solves this problem, because of how only a set number of bitcoins can be in circulation at any time, as well as using blockchain & DLT technology which means it’s near impossible to hack. In addition, there is no central agency owning cryp which gives control back to the people.

However I would like to warn about a glaring aspect of this. We should not jump right into the crypto-hype train just yet. Although, cryptocurrency is an extremely disruptive field towards finance, it should never replace traditional paper money and backing through physical objects such as gold. We should never have a cashless society. The over-reliance on technology will lead to eventual ruin when we do not have systems in place to prevent hacking, cyberviruses and a cyber blackout.

The meaning of having money in your pocket is because it’s an exchange of value, just as different regions of the planet have strong and weak currencies, we can use this exchange of value to buy goods, but to remove all cash with crypto would be insanity. Bitcoin is still backed by nothing.

Therefor we want to use these technologies in conjunction with our current system rather than replace it which is the whole point of DeFi (decentralized finance), it’s to decentralize the current system but it does not mean banks will be irrelevant. Decentralization of power means that everybody is at an equal footing which also includes banks.

Business wise, there is an interesting trend where companies are accepting payments through bitcoin and Ethereum. A company in Southeast Asia to watch out for is: Bitkub.com, a digital asset exchange, founded in Thailand. They have an ambitious goal to revolutionize the Thai & Southeast Asia’s virtual currency space and although it’s still too soon to say what the implications of Crypto are on the world, it’s not a trend that will not be slowing down, keep an eye for it.

Crowdfunding

Platforms such as Patreon are one such development of the crowdfunding industry, which allows content creators and influencers ways to accept donations. Influencers can use this platform to earn a monthly income by offering perks and benefits to their subscribers.

Kickstarter is also another funding company which runs through financial technology. Its goal is for ordinary people to be able to raise capital for their creative projects. Many creative projects that wouldn’t have been able to be created through the use of Crowdfunding in addition to lives being saved in the case of raising funds to pay people’s hospital bills. Marketing and storytelling still plays an important role in these platforms because it allows people to share their ideas and bring them to life.

My good friend Kaho, from Japan was such case, as she was able to raise capital for her project called: “Heart-Trip” which through crowdfunding, it allowed herself to fund her around the world trip in a span of a gap year.

This would not have been possible without crowdfunding.

The Future Is Here

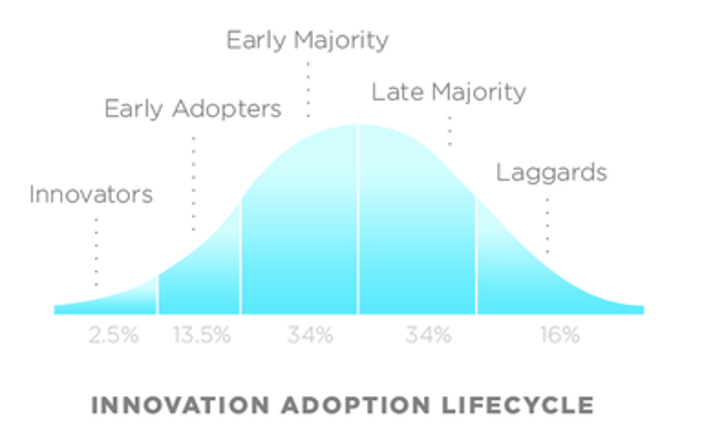

I hope you enjoyed this article as it is a small detour away from marketing and copywriting tips. However, as marketers, as businessmen/businesswomen, we have to understand key industry trends and base our decisions on what is going to happen rather than being reactive to the changing of tides. Use these trends to prepare for the future. Take a look at this chart called the “Diffusion of innovations”

This diagram shows the standard deviation of people that adopt innovation. Majority of people are right in the middle but many are also laggards and late majority. Usually the people that start all the trends you see in the world are either innovators or early adopters.

Do not be a laggard or late majority, as with a rapidly changing world, you will be left behind in this century just like the people that were left behind in the first industrial revolution, just like the people that tried to bring a knife to a gunfight and just like the people that did not jump in the first dot com bubble. The world has changed, we are living in a better version of the past and that’s why we have to adapt with the tide.

If you liked this article, then do not forget to download my free e-book “Cash-Emails” on which I share with you the top 7 winning templates I use for email marketing. Use this to 10x your revenue and your quality of work.

0 Comments